Medicare Advantage and Medicare Supplement plans are two major ways beneficiaries in the United States can enhance their healthcare coverage beyond Original Medicare (Parts A and B). Both options are offered through private insurers approved by Medicare, but they work very differently and are suited to different needs and preferences. Choosing the right plan can impact your out-of-pocket costs, access to doctors, and overall healthcare experience.

What Is Original Medicare?

Original Medicare consists of:

- Part A (Hospital Insurance) – Covers inpatient care, skilled nursing, and some home health services.

- Part B (Medical Insurance) – Covers outpatient care, doctor visits, preventive services, and medical equipment.

Beneficiaries usually pay a monthly Part B premium, deductibles, coinsurance, and copayments under Original Medicare.

Original Medicare does not place annual limits on your out-of-pocket costs, nor does it include most prescription drug coverage, dental, vision, or hearing benefits.

Medicare Advantage Plans (Part C)

Medicare Advantage (Part C) plans are an alternative way to receive your Medicare benefits through private insurance companies.

Core features:

- Combines Medicare Part A and Part B benefits into one plan.

- Many plans also include Part D prescription drug coverage and additional benefits like dental, vision, hearing, fitness, or over-the-counter allowances.

- Plans must cover at least the same services as Original Medicare, but they may limit coverage to specific provider networks (HMO or PPO).

- Most Medicare Advantage plans have an annual out-of-pocket maximum, giving financial protection in case of major medical needs.

Pros of Medicare Advantage:

- Often lower monthly premiums than Supplemental (Medigap) plans.

- Extra benefits not typically covered by Original Medicare.

- Annual out-of-pocket maximum provides predictable worst-case cost limits.

Considerations:

- Many plans require use of in-network doctors to get full benefits.

- Some plans require referrals to see specialists.

- Actual costs depend on plan details, premiums, deductibles, copays, and network structure.

Medicare Supplement Plans (Medigap)

Medicare Supplement plans, also called Medigap, are designed to work with Original Medicare (Parts A & B) to cover some of the out-of-pocket costs Medicare doesn’t pay.

Key characteristics:

- Medigap helps cover copayments, coinsurance, and deductibles left over after Medicare pays its share.

- You must have Original Medicare Part A and Part B to buy a Medigap policy.

- Premiums vary widely depending on plan type, insurer, and location. Typical monthly costs can range from around $30 to several hundred dollars.

- There are standard Medigap plan “letters” (A, B, C, D, F, G, K, L, M, N). All plans with the same letter offer the same basic benefits regardless of insurer, but availability and pricing differ by state.

Pros of Medigap:

- Freedom to choose providers that accept Medicare anywhere in the US.

- Predictable costs for covered services, especially if you use healthcare frequently.

- Some plans cover emergency care when traveling outside the U.S.

Considerations:

- Medigap does not include prescription drug coverage. You must enroll in a separate Part D plan for medications.

- Premiums are typically higher than Medicare Advantage on an ongoing basis.

- You can’t enroll in Medigap while enrolled in a Medicare Advantage plan; switching back to Original Medicare may affect eligibility for Medigap under typical rules.

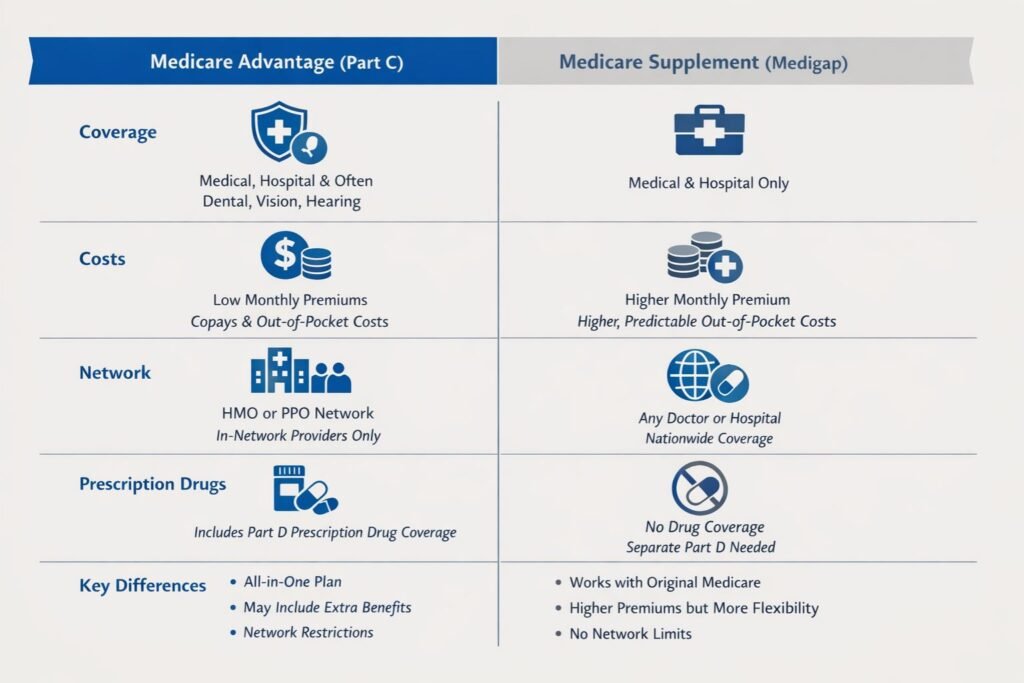

Medicare Advantage vs. Medigap: What’s the Difference?

| Feature | Medicare Advantage (Part C) | Medicare Supplement (Medigap) |

|---|---|---|

| Works with Original Medicare | No (replaces) | Yes (supplements) |

| Part A & B coverage | Included | You must have both |

| Prescription drugs | Often included | Separate Part D needed |

| Extra benefits (dental, vision, etc.) | Often included | Not typically |

| Provider choice | May require network | Any provider that accepts Medicare |

| Predictable out-of-pocket costs | Out-of-pocket max | Reduces costs but may still vary |

| Monthly premiums | Often lower | Typically higher |

Who Should Consider Which?

- Medicare Advantage may be suitable if you want lower monthly costs, extra benefits, and are comfortable with a provider network.

- Medigap may be a better choice if you want broad choice of doctors, predictable cost sharing, and you are willing to pay higher premiums for reduced out-of-pocket expenses.

Your choice should be based on healthcare needs, prescription drug needs, travel plans, and how much you value provider flexibility versus lower regular premiums.